ROLES AND FUNCTIONS OF RBI

Reserve Bank of India

Establishment:

The Reserve Bank of India was established in 1935 under the provisions of the Reserve Bank of India Act, 1934 in Calcutta, eventually moved permanently to Mumbai. Though originally privately owned, was nationalized in 1949.

Organisation and Management:

The Reserve Bank”s affairs are governed by a central board of directors. The board is appointed by the Government of India for a period of four years.

- Full-time officials : Governor and not more than four Deputy Governors. The current Governor of RBI is Mr. Urjit Pattel.

There are 4 Deputy Governors, BP Kanungo, S S Mundra, N S Vishwanathan and Viral Acharya. - Nominated by Government: ten Directors from various fields and two government Officials

- Others: four Directors – one each from four local boards

Main Role and Functions of RBI

- Monetary Authority: Formulates, implements and monitors the monetary policy for A) maintaining price stability, keeping inflation in check ; B) ensuring adequate flow of credit to productive sectors.

- Regulator and supervisor of the financial system: lays out parameters of banking operations within which the country”s banking and financial system functions for- A) maintaining public confidence in the system, B) protecting depositors’ interest ; C) providing cost-effective banking services to the general public.

- Regulator and supervisor of the payment systems: A) Authorises setting up of payment systems; B) Lays down standards for working of the payment system; C)lays down policies for encouraging the movement from paper-based payment systems to electronic modes of payments. D) Setting up of the regulatory framework of newer payment methods. E) Enhancement of customer convenience in payment systems. F) Improving security and efficiency in modes of payment.

- Manager of Foreign Exchange: RBI manages forex under the FEMA- Foreign Exchange Management Act, 1999. in order to A) facilitate external trade and payment B) promote development of foreign exchange market in India.

- Issuer of currency: RBI issues and exchanges currency as well as destroys currency & coins not fit for circulation to ensure that the public has adequate quantity of supplies of currency notes and in good quality.

- Developmental role : RBI performs a wide range of promotional functions to support national objectives. Under this it setup institutions like NABARD, IDBI, SIDBI, NHB, etc.

- Banker to the Government: performs merchant banking function for the central and the state governments; also acts as their banker.

- Banker to banks: An important role and function of RBI is to maintain the banking accounts of all scheduled banks and acts as banker of last resort.

- Agent of Government of India in the IMF.

Monetary Policy of RBI :

As discussed earlier, RBI executes Monetary Policy for Indian Economy. The RBI formulates monetary policy twice a year. It reviews the policy every quarter as well. The main objectives of monitoring monetary policy are:

- Inflation control

- Control on bank credit

- Interest rate control

The monetary policy (credit policy) of RBI involves the two instruments given in the flow chart below:

Quantitative Measures

Quantitative measures refer to those measures that affect the variables, which in turn affect the overall money supply in the economy.

Instruments of quantitative measures:

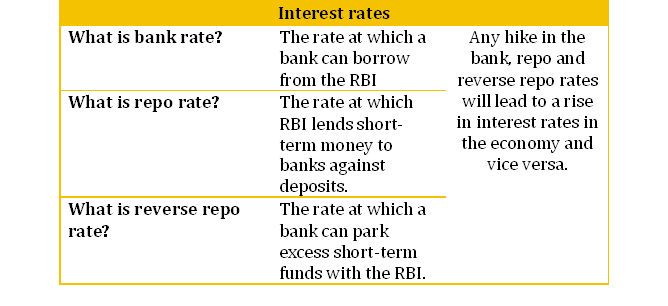

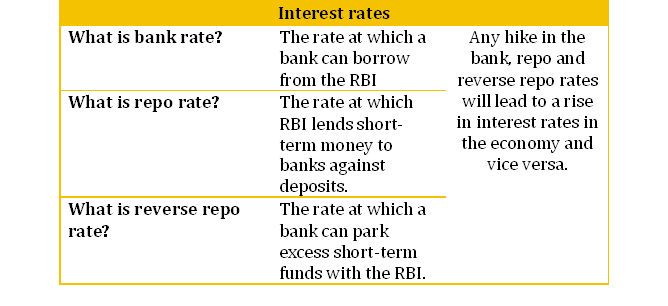

1. Bank rate −The rate at which central bank provides loan to commercial banks is called bank rate. This instrument is a key at the hands of RBI to control the money supply in long term lending. At present it is 8.75%.

Instruments of quantitative measures:

1. Bank rate −The rate at which central bank provides loan to commercial banks is called bank rate. This instrument is a key at the hands of RBI to control the money supply in long term lending. At present it is 8.75%.

Increase in the bank rate will make the loans more expensive for the commercial banks; thereby, pressurizing the banks to increase the rate of lending. The public capacity to take credit at increased rates will be lower, leading to a fall in the volume of credit demanded.

- The reverse happens in case of a decrease in the bank rate. This increases the lending capacity of banks as well as increases public demand for credit and hence will automatically lead to a rise in the volume of credit flowing in the economy.

2. Liquidity Adjustment Facility-

Reserve Bank of India’s LAF helps banks to adjust their daily liquidity mismatches. LAF has two components – repo (repurchase agreement) and reverse repo.

(i) Repo Rate: Repo (Repurchase) rate is the rate at which the RBI lends shot-term money to the banks against securities. When the repo rate increases borrowing from RBI becomes more expensive.Repo rate is always higher than the reverse repo rate. At present it is 7.75%

(ii) Reverse Repo Rate: It is the exact opposite of repo. In a reverse repo transaction, banks purchase government securities form RBI and lend money to the banking regulator, thus earning interest. Reverse repo rate is the rate at which RBI borrows money from banks.The banks use this tool when they feel that they are stuck with excess funds and are not able to invest anywhere for reasonable returns. At present it is 6.75%

(iii)Marginal Standing Facility (MSF): is a new scheme announced by the Reserve Bank of India (RBI) in its Monetary Policy (2011-12). The MSF would be a penal rate for banks and the banks can borrow funds by pledging government securities within the limits of the statutory liquidity ratio SLR.

The scheme has been introduced by RBI for reducing volatility in the overnight lending rates in the inter-bank market and to enable smooth monetary transmission in the financial system. Currently, it is 8.75%

2. Varying reserve ratios –

The reserve ratio determines the reserve requirements that banks are liable to maintain with the central bank. These tools are:

(i) Cash Reserve Ratio (CRR)

It refers to the minimum amount of funds in cash( decided by the RBI) that a commercial bank has to maintain with the Reserve Bank of India, in the form of deposits. An increase in this ratio will eventually lead to considerable decrease in the money supply. On the contrary, a fall in CRR will lead to an increase in the money supply. Currently, it is 4%.

It refers to the minimum amount of funds in cash( decided by the RBI) that a commercial bank has to maintain with the Reserve Bank of India, in the form of deposits. An increase in this ratio will eventually lead to considerable decrease in the money supply. On the contrary, a fall in CRR will lead to an increase in the money supply. Currently, it is 4%.

(ii) Statuary Liquidity Ratio (SLR)

SLR is concerned with maintaining the minimum percentage( fixed by RBI) of assets in the form of non-cash with itself. The flow of credit is reduced by increasing this liquidity ratio and vice-versa. As SLR rises the banks will be restricted to pump money in the economy, thereby contributing towards decrease in money supply. The reverse case happens if there is a fall in SLR, it increases the money supply in the economy. Currently SLR is 21.5%

SLR is concerned with maintaining the minimum percentage( fixed by RBI) of assets in the form of non-cash with itself. The flow of credit is reduced by increasing this liquidity ratio and vice-versa. As SLR rises the banks will be restricted to pump money in the economy, thereby contributing towards decrease in money supply. The reverse case happens if there is a fall in SLR, it increases the money supply in the economy. Currently SLR is 21.5%

Comments

Post a Comment